|

| NDX100 Daily Chart @ Close 12/17/2015 |

So far so good with a reversal & losses; Trade Plan now to take back 1/2 Tactical Short should the GAP @ 4571.2 get closed.

Our S/L? Work in Progress.

|

| NDX100 Daily Chart @ Close 12/17/2015 |

|

| NDX100 Daily Chart @ Close 12/15/2015 |

|

| NDX100 Daily Chart @ Close Friday 12/11/2015 |

|

| WTI CFD: Daily Chart @ Close 12/08/2015 |

|

| DJT Daily Chart @ Close 12/08/2015 |

|

| NDX Daily Chart @ Close 12/03/2015 |

|

| NDX100 Daily Chart @ Close 11/23/2015 |

|

| S&P500 Daily Chart @ Close 11/16/2015 |

|

| $BTK Daily Chart @ Close 11/11/2015 |

|

| S&P500 Weekly Chart 2010- 15. |

|

| S&P500 Daily Chart @ Close 10/21/2015 |

|

| S&P500: 1987 Daily Chart |

|

| S&P500 Daily Chart @ Close 10/13/2015 |

|

| S&P500 Daily Chart @ Close 10/01/2015 |

|

| NYSE Daily Chart @ Close 09/16/2015 |

|

| S&P500 Daily Chart @ Close 09/09/2015 |

|

| USD Index Weekly Chart @ Close 08/21/2015 |

|

| S&P500 Daily Chart @ Close 08/20/2015 |

|

| Apple (AAPL) Daily Chart @ Close 08/11/2015 |

|

| S&P500 Daily Chart @ Close 07/23/2015 |

|

| SSEC Daily Chart @ Close 07/09/2015 |

|

| S&P500 Daily Chart @ Close 06/29/2015 |

|

| US Dollar Index Weekly @ Close 06/12/2015 |

|

| NYSE Daily Chart @ Close 05/18/2015 |

|

| S&P500 Weekly Chart @ Close Friday 05/08/2015 |

|

| S&P500 Daily Chart @ Close 04/27/2015 |

|

| NYSE Daily Chart @ Close 04/17/2015 |

|

| NYSE: Daily Close @ 03/25/2015 |

|

| NYSE Intra- Day Daily Chart 03/05/2015 |

|

| NYSE Daily Chart @ Close Feb 3rd 2015 |

|

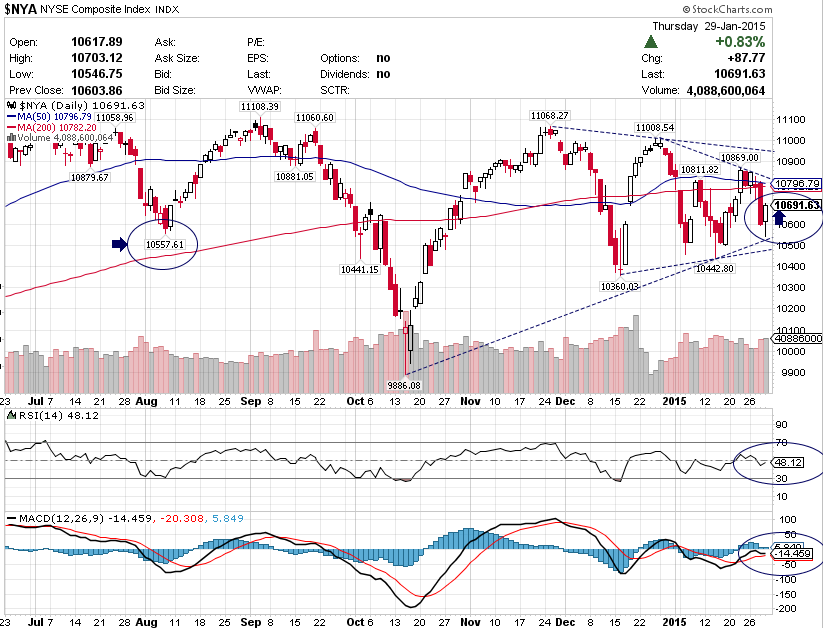

| NYSE Daily Chart @ Close 01/29/2015 |

|

| Dow Transports Daily Chart @ Close 01/06/2015 |