|

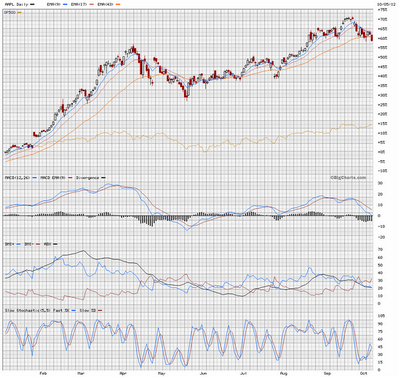

| S&P500 Daily Close @ 10/25/2012 |

If THAT is so; then this sell-off should retrace 38% of the gains from the Secondary Lows @ 1309......right here @ 1411+/-.

Yesterday's 'Reversal' goes a long to suggesting as much, though not confirmed though by other 'brethren' indices in the $NYSE & $NDX100.

Overnight Futures 'action' is suggesting this prognosis is too 'early' & likely 'wrong'......but that can all change before the bell rings on the floor of the NYSE.