|

| NDX Daily Close @ 12/26/2012 |

What gives?

The 'Grinch' may well have stolen the Year-End festivities with a stumbling end to a 'stumbling' year?

|

| NDX Daily Close @ 12/26/2012 |

|

| GE Weekly Close @ 12/21/2012 |

|

| GE: Daily Chart @ Close 12/19/2012 |

|

| Apple (AAPL) Daily Close as @ 12/17/12 |

|

| NDX100 Daily Close @ 12/13/12 |

|

| NYSE Daily Close @ 12/12/12 |

|

| Philly Banking Index ($BKX): Daily Close @ 12/11/12 |

|

| NDX100 Daily Close @ 12/07/2012 |

|

| Apple (APPL): Daily Chart Close @ 12/06/2012 |

|

| NYSE Daily Close as at 12/03/2012 |

|

| NDX100 Daily Close @ 11/30/2012 |

|

| S&P500 Daily Close @ 11/23/2012 |

|

| S&P500 Daily Chart @ Close: 11/19/2012 |

|

| S&P500 Daily Close @ 11/14/2012 |

|

| S&P500 Weekly Chart @ Close 11/09/2012 |

|

| NDX100 Daily Close 11/02/2012 |

|

| S&P500 Daily Close @ 10/25/2012 |

|

| COPPER Daily Chart @ Close 10/24/2012 |

|

| DOW JONES TRANSPORTS @ Close 10/24/2012 |

|

| S&P500 Daily Close @ 10/22/2012 |

|

| S&P500 Daily Close @ 10/18/2012 |

|

| NDX100 Daily Close @ 10/17/2012 |

|

| AAPL Daily Close @ 10/17/2012 |

|

| Apple (AAPL): Daily Chart Close @ 10/12/2012 |

|

| Apple/ S&P500: Daily Chart @ Close 10/05/2012 |

|

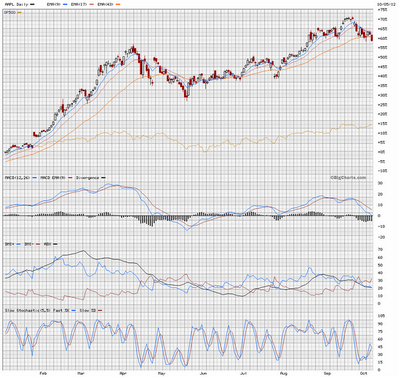

| ASX200 Weekly Chart @ as Close 10/03/12 |

|

| German IFO Survey September 2012 |

|

| Dow Jones Transports Weekly Chart @ Close 09/24/2012 |

|

| Brazil's BOVESPA Close @ 09/17/2012 |

|

| Brazil's BOVESPA: Weekly as @ 09/13/2012 |

|

| COPPER Daily Chart 09/12/2012 |

|

| SPX Daily Close @ 09/10/2012 |

|

| S&P500 Daily Close @ 09/06/2012 |

|

| ASX200 Daily Close @ 08/28/2012 |

|

| COPPER Daily Chart Close @ 08/23/12 |

|

| Straits Times Index (STI) Daily Close @ 08/23/212 |

|

| NDX100 Daily Close @ 08/23/2102 |

|

| BOVESPA Weekly Close @ 08/17/2012 |

|

| Brazil's BOVESPA Daily Close @ 08/16/2012 |

|

| BOVESPA Daily 08/15/2012 |

|

| Close 08/14/2012 |

|

| Brazil's BOVESPA: Close @ 08/08/2012 |

|

| Brazil's BOVESPA Daily Close @ 08/07/2012 |

|

| NDX100 Daily Close @ 08/06/2012 |

|

| DAX Daily Close @ 08/06/2012 |

|

| Industrial Metals Index ($GYX) Close @ 08/03/2012 |

|

| DAX Daily Close @ 08/01/2012 |

|

| DAX Daily Chart @ close July 27 2012 |

|

| German DAX Daily Chart as @ Close 07/20/12 |

|

| IXIC Daily Close @ 07/19/2012 |