|

| NYSE Intra- Day Daily Chart 03/05/2015 |

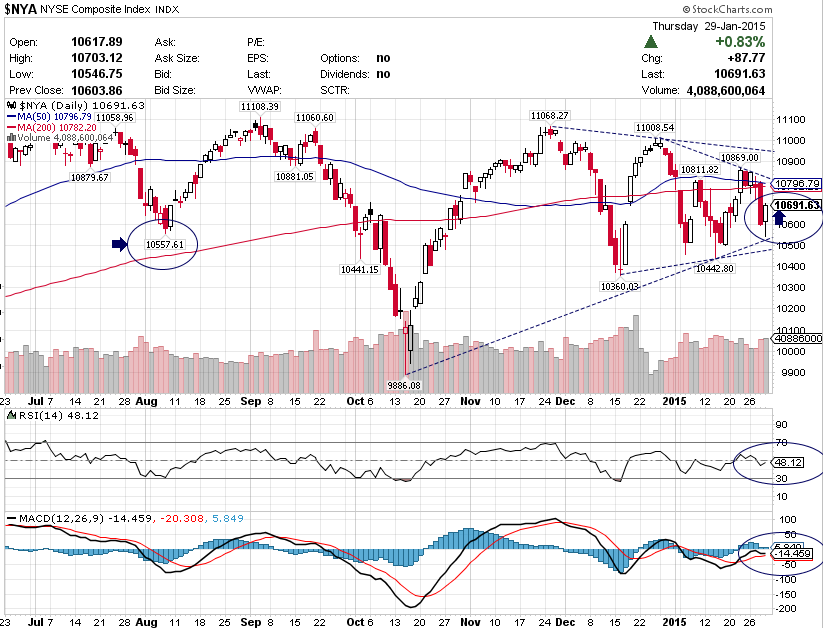

Sell Signal on the MACD post the Indecision @ the New Record Highs & the NYSE could well 'beat' a hasty retreat back to as low as 10,400.

So; where was the Rally here since mid 2014?

|

| NYSE Intra- Day Daily Chart 03/05/2015 |

|

| NYSE Daily Chart @ Close Feb 3rd 2015 |

|

| NYSE Daily Chart @ Close 01/29/2015 |

|

| Dow Transports Daily Chart @ Close 01/06/2015 |

|

| S&P500 Daily Chart @ Close 12/16/2014 |